ABOUT US

Our History

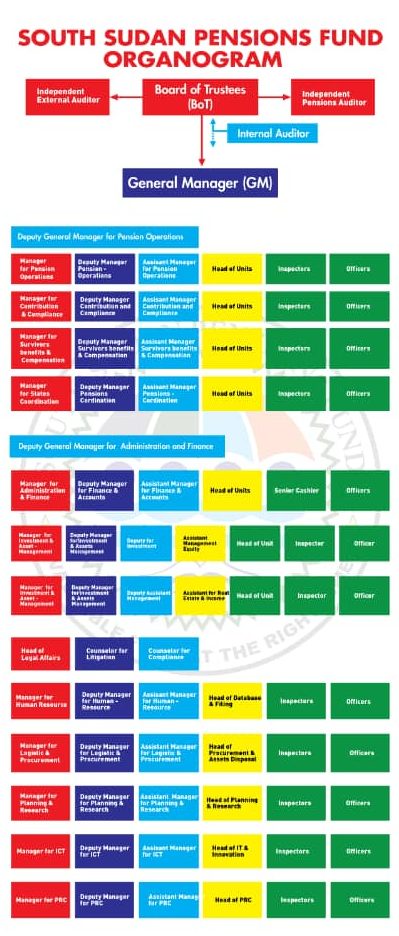

The South Sudan Pensions Fund (SSPF) came to existence as one of the public institutions of the newly born country - South Sudan - following independence in 2011. Soon after independence, the Fund was legally established by the Pensions Fund Act (2012). To operationalize the institution, the first Board was established and a General Manager was appointed. In 2019, the Board recruited the first General Manager again and established two Departments (i.e., the Department of Operations and the Department of Administration and Finance), followed by the establishment of the Investment Department, which was previously under the Administration and Finance Department. As the term for the second Board elapsed in March 2019, the Fund remained without a Board until a new Board was established in July 2021, which is currently striving to put in place systems, policies and procedures. As part of this effort, the Board issued a new Investment Policy and Procedure as well as a Procurement Policy and Procedure. The Cash Book (for Accounts) system was put in place while modern systems such as the Pensions Information Management System (PIMS) and the Quick Book - a Financial Management System - are being developed. SSPF started operation with the remittance from the Ministry of Finance. The Ministry started to cut Pension contribution from 2016 onwards while contributions were supposed to start in 2006. Hence, the Government has arrears from 2006 to 2016. The SSPF is also yet to receive contributions for past service, for employees who served both in Sudan and South Sudan. Even though the Act provides for the participation of Pension Schemes in the Fund, there are no legally established schemes yet. Furthermore, contributions have not been properly remitted to the Fund by public institutions in the central government and the States. Particularly, participation of the sates has been almost inexistent except for some efforts by one state.

Mission

“To ensure the Fund’s sustainability and maximize benefits to Pensioners/Survivors by enhancing Pensions awareness and participation, registration, Pensions contributions collection, inspection and enforcement, prudent investment and management of Pension Assets, and payment of reasonable Pensions benefits”

Vision

“Aspiring to see optimal participation, sustainable Fund, and reasonable Pensions benefits surpassing the income poverty line by the year 2042”

Core Values

Customer-Focus

Stewardship

Fairness/Equity

Professionalism

Collaboration

Transparency

Accountability

Governance

The Board of Trustees considers corporate governance as a key pillar in the management of the Fund and accountability to the Sponsor and members. There are several aspects to pensions governance, including: ensuring that the pension fund runs efficiently, making sure the costs and charges are known and reduced.

In accordance with the provisions of Articles 55 (2) (3) (b) and 85 (1) of the Transitional Constitution of the Republic of South Sudan, 2011, Transitional National Legislative Assembly, with the assent of the President hereby enacts the following.

TITLE AND COMMENCEMENT.

This Act shall be cited as “The Civil Service Pension Scheme Act, 2013” and shall come into force on the date of its assent by the President.

The purpose of this Act is to establish a Pension Scheme for civil servants employed by the National, State and County Governments and to specify the rules for Pension Contributions, records keeping, Pension awards and payments. Men and women shall be accorded full and equal benefits with respect to all provisions of this Act.

This Act is drafted in accordance with the provisions of Articles 52 and 138 (3), read together with the provisions of Schedule (A) paragraphs (36) and

(37) of the Transitional Constitution of the Republic of South Sudan, 2011, and the provisions of Section 93 of the Civil Service Act, 2011, that grant the National Government the legislative competence to determine the terms, conditions of service, duties and rights of the employees in the civil service, including the post-service- benefits, pensions and matters related thereof.

The provisions of this Act shall apply to all Employees in the civil service at the National, State and County levels of Government, in all matters related to Pensions policy, management and payment of Pensions of Employees employed by the Public Institutions, including:

(a) Employees retired from Pensionable Service from a Public Institution before the commencement of this Act, who were previously awarded a Pension, and their Survivors;

(b) Employees retired from Pensionable Service from a Public Institution on the commencement of this Act, who have not been awarded a Pension, and their Survivors;

(c) Employees who are in Pensionable Service for a Public Institution on the effective date of this Act, and their Survivors;

(d) Employees hired into Pensionable Service for a Public Institution after the commencement of this Act, and their Survivors; and

(e) Employees retired from Pensionable Service from a Public Institution before the commencement of this Act and re-appointed to Pensionable Service for a Public Institution after the commencement of this Act, and their Survivors.